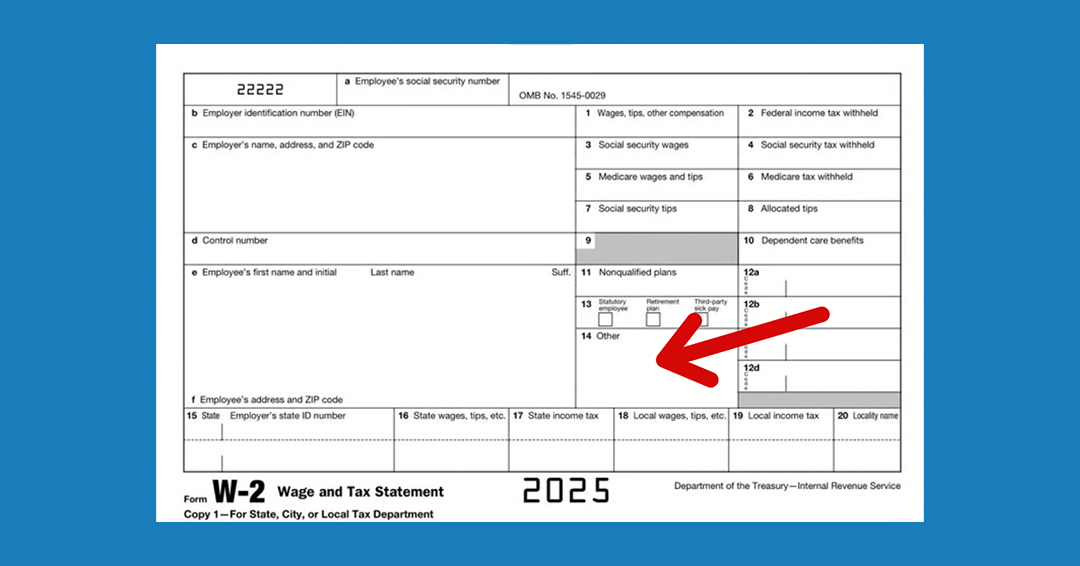

Overtime Reporting: OMS Uses Box 14 of W-2

Under the new 2025 tax law, a specific portion of your overtime pay (referred to as Qualified Overtime) may be deducted from your federal taxable income. However, employers are not required to separately report overtime wages on the W-2 for 2025.

To make this easier, OMS will report Qualified Overtime in Box 14 of the W-2 this year. Box 14 is traditionally used to provide additional information that does not fit elsewhere on the form. We are labeling box 14 as OT and reporting all Qualified Overtime in this space.

It’s important to note that not all overtime pay is deductible or non-taxable. This change does not affect other taxes or deductions on your paycheck. It simply allows you to deduct a specific portion of your overtime pay, as outlined below.

What counts as “Qualified Overtime”?

The new law only allows the premium portion of your overtime pay (the extra amount you earn for working more than 40 hours in a week) to count as “Qualified Overtime.” Only this premium pay is eligible for a federal income tax deduction, and it is subject to certain limits.

When you file your taxes, your tax preparer or tax software should use the amount listed in Box 14 (OT) to reduce your federal taxable income. This means you may not pay federal income tax on that specific portion of your earnings, up to the applicable limits.

Fore more information, visit the IRS website.

This document is provided for general informational purposes only and does not constitute legal, tax, or insurance advice. Employers should consult with qualified legal counsel or a licensed insurance professional regarding specific workers’ compensation requirements and compliance obligations under Florida Statutes, Chapter 440. Regulations and requirements may vary depending on industry classification, number of employees, and other factors. OMS PEO assumes no liability for actions taken or not taken based on the contents of this document.